Wealth Building vs Performance Chasing in light of Mega-cap Technology Companies’ Stock Market Concentration

Amid the constant media attention about AI and the largest technology stocks, we offer our perspective on the present degree of market concentration. These companies, which include Apple, Microsoft, Google, Amazon, Meta, and Nvidia are noteworthy for their strong revenue and earnings growth and their exceptional performance in recent years, leading to their current substantial market capitalizations.

Many are wondering whether this concentration can persist, or even increase further. If so, should portfolios be reconfigured to add aggressively to these stocks now? Our analysis leads us to believe that while the business prospects for these companies continue to appear promising, further concentration in a portfolio would not be prudent.

How the Current Level of Market Concentration Occurred

Over the last decade:

US Large Cap stocks (S&P 500) have far outperformed all other major equity indexes.

Within US Large Cap, a very small number of technology stocks have greatly outperformed.

To have merely kept pace with the S&P 500, much less outperformed, an investor would have had to not just own those few stocks, but also maintained a high degree of portfolio concentration in them.

Historically High Level of Market Concentration

The current level of concentration is second only to the historical peak in the late 1960s, with the “Nifty 50”, and is now even more concentrated than during the tech bubble peak of the late 1990’s. Following both prior peak periods, those market leaders subsequently underperformed for many years.

Investors Already Anticipating High Growth

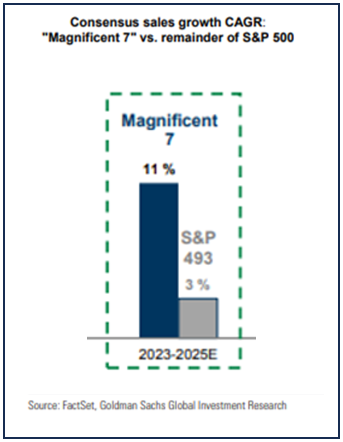

We believe the future growth for these mega-cap technology companies will be quite good.

As indicated below, consensus expectations are also positive on future revenue growth and profit margin improvement. Their growth and profitability are also significantly higher than for the rest of corporate America.

High expectations are also reflected in the dramatic increase in the level of media attention:

Valuations of the Mega-cap Technology Stocks

From a stock investor's perspective, strong fundamental performance is no longer a positive surprise but an expectation. Anything less in the future will be a disappointment. This is evident in the fact that:

The mega-cap technology stocks are significantly more expensive, relative to their expected earnings growth, than they were ten years ago.

The gap between the valuation-to-growth for the mega-cap technology stocks and the median stock in the S&P 500 is high. This premium valuation commanded by these mega-cap technology stocks does not leave much room for disappointment.

Wealth Building vs Performance Chasing

Chatham’s objective for equity investing is to generate compound annual real returns (nominal returns less inflation) that will allow the purchasing power of wealth to grow over time. We think this approach is more relevant and more likely to achieve investment success than chasing benchmark returns that are indifferent to both client circumstances and risk considerations.

High quality, growing companies with rising dividends are able to withstand business cycles and competitive threats better than lower quality companies. As an indicator of their business strength, during Covid, the inflation adjusted dividends of Chatham’s portfolio stocks increased an average of 0.2%. This compares quite favorably to the 10% decrease in the S&P 500’s inflation-adjusted dividends.

Conclusions

We do not know how much longer the mega-cap technology stocks will continue to dominate the other companies in the S&P 500 index. Chatham portfolios have representation in these companies and intend to continue holding them. Our percentage of a portfolio’s weighting in these stocks is typically less than their weighting in the S&P 500 Index, and we do not anticipate further increasing exposure. Our equity emphasis is high quality, growing companies that pay dividends, and that tend to trade at more reasonable valuations. This approach is designed to meet our client’s financial needs and objectives.